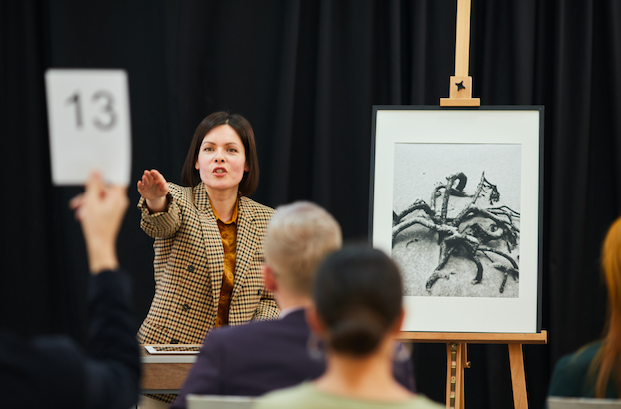

In the October 2020 episode of our Wealth Matters radio show, Gaslowitz Frankel partners Adam Gaslowitz and Craig Frankel met virtually with special guests Allen Venet, Estate and Trust Advisor at SunTrust Bank (now Truist), and Alyssa Quinlan, Chief Business Development Officer at Hindman Auctions, to discuss the ins and outs of planning, appraising, and auctioning personal property.

In the October 2020 episode of our Wealth Matters radio show, Gaslowitz Frankel partners Adam Gaslowitz and Craig Frankel met virtually with special guests Allen Venet, Estate and Trust Advisor at SunTrust Bank (now Truist), and Alyssa Quinlan, Chief Business Development Officer at Hindman Auctions, to discuss the ins and outs of planning, appraising, and auctioning personal property.

Here are some highlights from their discussion.

What is personal property?

Simply put, personal property consists of things. This differs from “assets” which include both intangible and tangible items of value. Personal property refers only to assets that are movable belongings, excluding land and buildings.

What types of disputes arise from personal property?

“It’s relatively easy, no matter how well the family gets along, to split up things like publicly traded shares,” says Allen. “Obviously there could be more challenges with someone like a family business, but not too many families have those. The real challenge is divvying up the personal effects.”

Craig adds, “That’s actually where we see the biggest fights. Even when there’s a lot of money in the estate, which is what you would assume the argument would be about, we actually see more conflicts arise from the teapot or the family’s secret recipes.”

According to Alyssa, it’s all about the emotional attachment. While of course every heir wants their fair share of the money, the sentimental, tangible items have the most power to raise conflict as they hold the most emotional value.

“I’d like to add that most of the time this passion masks as emotional attachment to a certain item, when really it’s about grief and a person’s attachment to the deceased,” Adam clarifies.

Is there a way to split personal property among heirs?

Intangible items such as a stock portfolio are easier to ration out, but figuring out how to divide up a family heirloom or a valuable painting is much more difficult.

“There are some people who have fractional interest, so we do see some clients who have a rotational schedule for a painting,” says Alyssa. “Family A might have the painting for one holiday, and then by Christmas, it’s hanging over Family B’s fireplace.”

In situations like this, there is extensive planning that must be done ahead of time to lay out the terms of the agreement. Otherwise, it’s very likely that fights and even disputes could arise down the road.

What is a fair market value appraisal?

Before items from an estate can be auctioned, they require what is called a fair market value appraisal. This process determines the value of an item you purchased X number of years ago.

Allen says that 99/100 times, items end up being worth only a fraction of their original selling price. However, there are instances where the value for certain pieces of personal property increases, and they could actually be sold at a profit.

In order to ensure you are treating your heirs equally, and in order for said heirs to truly understand the value of the personal property they are receiving, hiring a fair market value appraiser is necessary.

For more information on auctioning, valuing, and planning for personal property, watch the full episode of “Wealth Matters” here.

Gaslowitz Frankel LLC is the Southeast’s premier fiduciary litigation law firm. Our legal team specializes in all aspects of fiduciary disputes representing individuals, executors, trustees, investors, shareholders, and corporate fiduciaries in complex fiduciary disputes involving wills, estates, trusts, guardianships, and businesses. If you are involved in a fiduciary dispute, contact us for a consultation.